COVID-19 Resources for Employers & Brokers

Due to COVID-19, the federal government has made many changes to Flexible Spending Accounts, Health Reimbursement Arrangements, Health Savings Accounts, Commuter Benefits and COBRA. You will find all the latest information within this article, along with any documents you may need to make amendment changes to your plan. We also have a downloaded FAQ guide for you to get all of your COVID-19 related questions answered. If you have any questions or need to make changes to your benefit plans, please email ebs@naviabenefits.com.

Click here to download our complete COVID-19 Plan Amendments Guide with links to individual plan amendments for each change. Everything you need in one place! This guide includes a description of the amendment, why you should or should not amend your plan, which plans it affects, if it’s mandatory or voluntary, and a link to download the plan amendment. Please email clientservices@asibenefits.com with your completed amendment.

Impact of the CARES Act Guide

On March 27, 2020, the federal government passed and signed into law the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, that includes a wide-ranging set of emergency funds and relief provisions for businesses and individuals experiencing hardships as a result of the COVID-19 pandemic. Several of the provisions are related to the use of healthcare Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), and Health Reimbursement Arrangements (HRAs) to help individuals use these accounts to purchase needed health care items. The questions and answers in this guide are intended to simplify the key points of the CARES Act for employers and participants as it relates to the use of their benefit accounts. Download the guide here.

FAQs for Employers During the COVID-19 Pandemic

As our situation changes daily, ASi is committed to bringing you the latest information about managing your benefits during the COVID-19 crisis. We will be updating this post often as we get new information and expand our FAQs to respond to your most frequently asked questions.

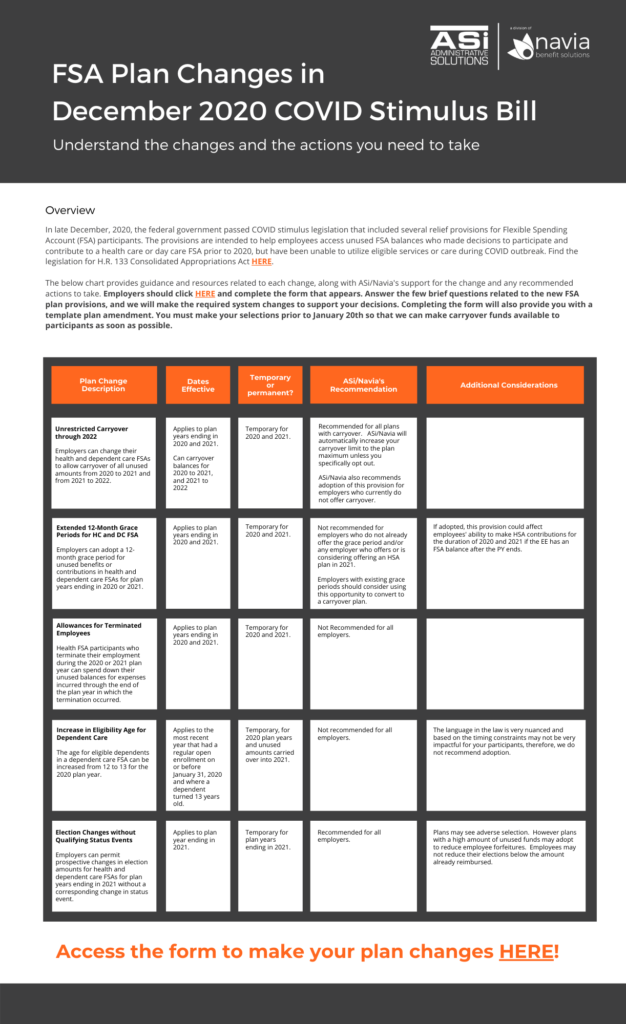

December 2020 FSA Provisions

In late December, 2020, the federal government passed COVID stimulus legislation that included several relief provisions for Flexible Spending Account (FSA) participants. The provisions are intended to help employees access unused FSA balances who made decisions to participate and contribute to a health care or day care FSA prior to 2020, but have been unable to utilize eligible services or care during COVID outbreak. Find the legislation for H.R. 133 Consolidated Appropriations Act HERE.

Below are the provisions being made from this COVID stimulus legislation and ASi/Navia’s recommended actions to take. We also have participant facing material in which employers/brokers can edit and provide to their employees.

FSA Plan Changes in December 2020 COVID Stimulus Bill

Click here to download our FSA Plan Changes in December 2020. This guide includes a description of the amendment, why you should or should not amend your plan, and whether ASi/Navia recommends the change. In order to make changes to your plan, there is a link to an online form for you to fill out. At the end of completing the form you will be able to download a template amendment for your records. Please email clientservices@asibenefits.com with your amendment.

Participant Communication for FSA Plan Changes

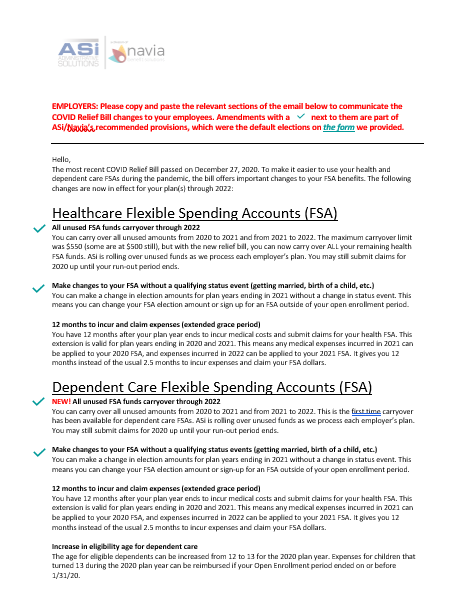

Download our Word document for participant communication. You can edit the document or copy and paste the relevant sections of the email below to communicate the COVID Relief Bill changes to your employees. Amendments with a checkmark next to them are part of ASi/Navia’s recommended provisions.

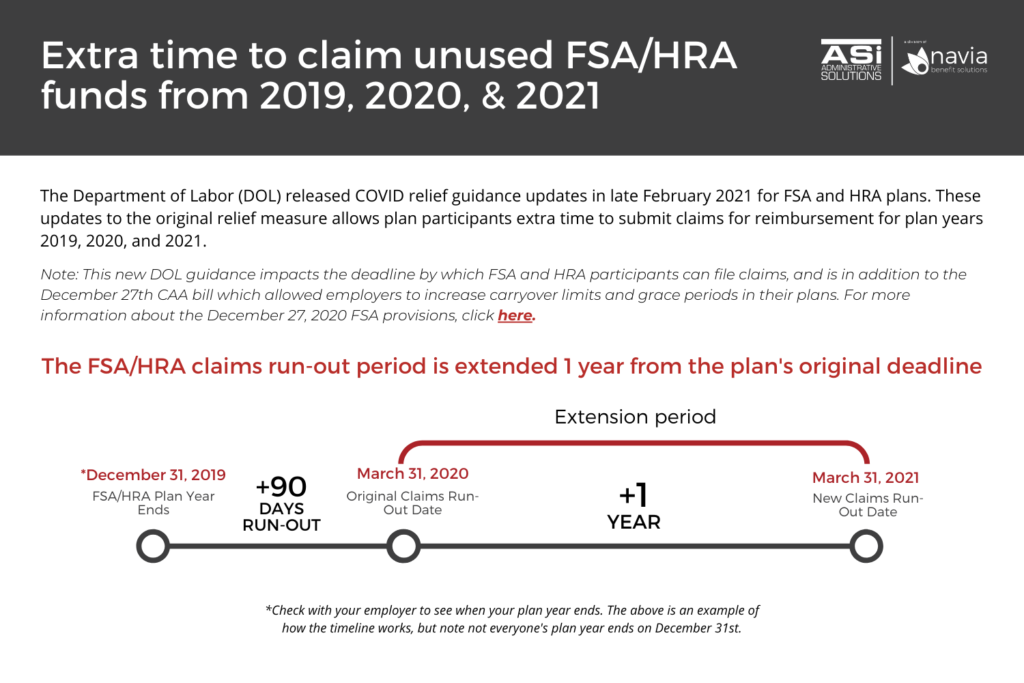

New DOL COVID Relief Guidance February 2021

The Departments of Treasury and Labor previously issued notices in March and April of 2020 that extended or paused various benefit plan deadlines based on the declaration of the National Emergency on March 1st, 2020. The relief extensions were set to expire at the end of one year on Sunday, February 28th, 2021, with an additional 60 days beyond the expiration of the National Emergency relief after which FSA and HRA plan run-out periods that were paused in 2020 would resume. This past Friday, February 26th, the Department of Labor issued EBSA Disaster Relief Notice 2021-01, which changes and clarifies deadlines for FSA and HRA plans.

Below is the updated timeline for FSA/HRA plans. Click the image to download copy.